Nordson’s Earnings Report: Insights into Aug 21’s Announcement

Dividend Increase Announcement

Nordson Corporation (NASDAQ:NDSN) has given its investors reason to cheer with a forthcoming hike in its periodic dividend, scheduled for disbursement on September 5th. The dividend has been elevated to $0.68, a 4.6% leap from last year’s $0.65. Yet, even with this uptick, the dividend yield retains a modest position at 1.1%.

Sturdy Coverage of Dividend by Earnings

A consistent dividend often becomes a magnet for investors, and in the case of Nordson, the company’s earnings capably cover the dividend. This highlights that a significant portion of its earnings goes back into fostering business expansion. With future indicators pointing to an EPS growth of 35.1% in the next year, and assuming the dividend trajectory remains unaltered, we could see a potential payout ratio of 24%.

Decade of Dividend Reliability

Nordson’s dividend distribution over the years hasn’t just been regular, but has also carried an element of stability. Looking back, the annual dividend in 2013 was $0.60, contrasting with the most recent full-year amount of $2.60. This denotes an impressive annual growth rate of nearly 16%, a trend that will likely instill confidence among investors.

Potential Dividend Expansion

Nordson’s legacy of dividend distribution hints at a promising future for its shareholders. With the company’s EPS recording a growth of 6.7% over the preceding five years, and in light of the low reported payout ratio, it’s plausible to anticipate a rosy dividend landscape ahead.

Aug 21 Earnings Anticipation

As we inch closer to the earnings report due on Aug 21, the financial sector is all ears. While the recent consensus for fiscal third-quarter earnings saw a minor downward revision, Nordson’s past performance remains laudable, having outperformed estimates in three out of the last four quarters, with an average beat of 3.1%.

Factors Impacting the Quarter

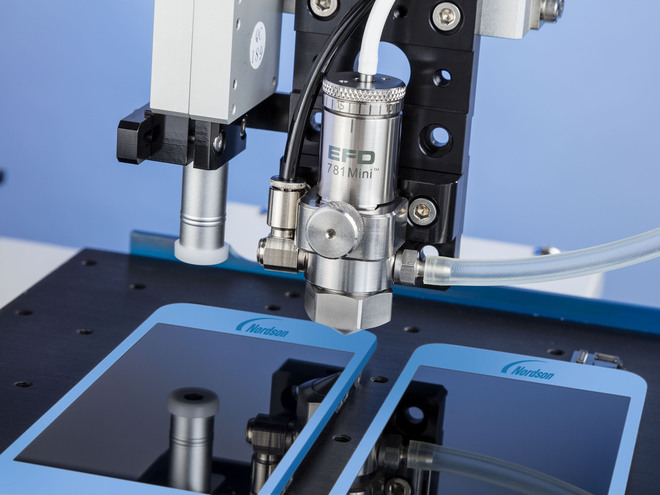

The fiscal third quarter for Nordson might see a boost due to robust customer demand across various sectors like industrial, consumer non-durable, and medical. However, potential headwinds could emerge from a drop in electronics dispense and CyberOptics product lines. Additionally, with Nordson’s expansive international operations, fluctuations in foreign currencies might pose challenges to the top-line figures.

Earnings Predictions

While forecasts regarding Nordson’s earnings remain open-ended, both current consensus and the most accurate estimates hover around $2.31.

Previous Quarter in Retrospect

Reflecting on the previous quarter (ended Apr 30, 2023), Nordson reported adjusted earnings of $2.26 per share, surpassing the prevailing market estimate, albeit recording a 7% dip from the prior year. Concurrently, total revenues witnessed a 2.3% YoY surge.

Other Stocks to Monitor

Apart from Nordson, other companies such as Deere & Company and Bank Of Montreal are generating buzz due to their impending earnings announcements.

Week Ahead

The imminent earnings report from Nordson combined with the dividend increment news makes the upcoming week a potentially exciting one for stakeholders. While the company’s consistent track record and growth metrics position it positively, the market’s reaction remains a keen point of interest.